Other files (SIBS Backoffice)

SIBS’ Marketplace solution also provides a list of registered Submerchants by status. This list can be extracted directly via API or through SIBS Backoffice platform.

SIBS’ Marketplace solution also provides a list of registered Submerchants by status. This list can be extracted directly via API or through SIBS Backoffice platform.

The Daily File for the Marketplace Operator aims to provide the Marketplace Operator with a detailed view of the transactions on its Marketplace, including all information regarding splits, payouts and settlement orders that have been created or changed between the generation of the last report and the time of creating of the new report

Unlike the Omni-Channel Statement for Merchants, in this file the Marketplace Operator will only view their transactions on the Marketplace solution, and not the remaining transactions on the other channels, such as SIBS Payment Gateway or Point-of-Sales (POS).

The EXTO file enables Merchants to receive, in an integrated manner, details of the transactions per reconciliation and respective fees, carried out through the different channels contracted with EATs and Acquirers, regardless of the scheme contracted. This file provides the Merchant with a complete and detailed overview of their payment business.

In the specific case of the Marketplace solution, the Marketplace Operator can view all transactions carried out on its Marketplace, with information per split, respective Submerchant and associated fee, along with its transactions on the other channels, if applicable.

There are three main reporting tools provided to the Marketplace Operator: Omni-channel file (EXTO file), Marketplace daily report and other reports available on SIBS Backoffice.

This tools are described in the following sections.

SIBS Backoffice is an online platform that allows Merchants, who are SIBS Customers, to access a set of useful features in the management and monitoring of business variables related to SIBS services. In the context of the Marketplace solution, SIBS Backoffice is used by the Marketplace Operator, SIBS, Acquirer, EAT and Submerchants as a backoffice tool, but also serves to register new Submerchants operating on the platform.

The features of SIBS Backoffice that are directly related to SIBS’ Marketplace solution are described in the following sections.

The “Marketplace” menu is displayed for customers who have contracted the Marketplace solution. Within this menu are two additional submenus: “Parameters” and “Submerchants”. In the “Parameters” submenu, the user can define the type of validations they wish to be applied to their Submerchants and, through the “Submerchants” submenu, the Marketplace Operator has the opportunity to register new Submerchants or inquire Submerchants already registered in the solution.

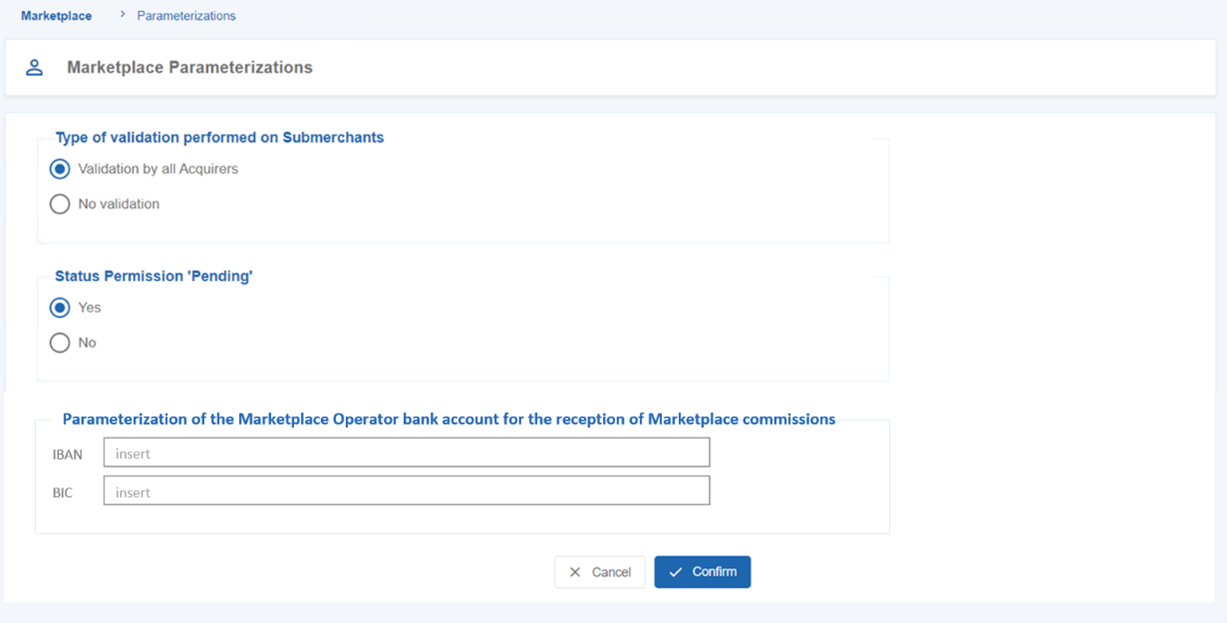

In the “Parameters” submenu, the user must define who will be responsible for validating the Submerchants. This process, required by payment industry regulations, can be performed by the Acquirer(s) of the solution or can be delegated to the Marketplace Operator.

By selecting the option “Validation by all Acquirers”, the User must also define if they want the Submerchant “Pending” status to be allowed or not. If the User selects the “No validation” option, Acquirers do not have to perform KYC validation and Submerchants move directly to the “Active” status. This second option must be selected when the validation of Submerchants is delegated to the Marketplace Operator, who must only register in the solution Submerchants that have already been validated.

In this submenu, the Marketplace Operator must also define the IBAN and BIC of the bank account where they wish to receive their Marketplace fees.

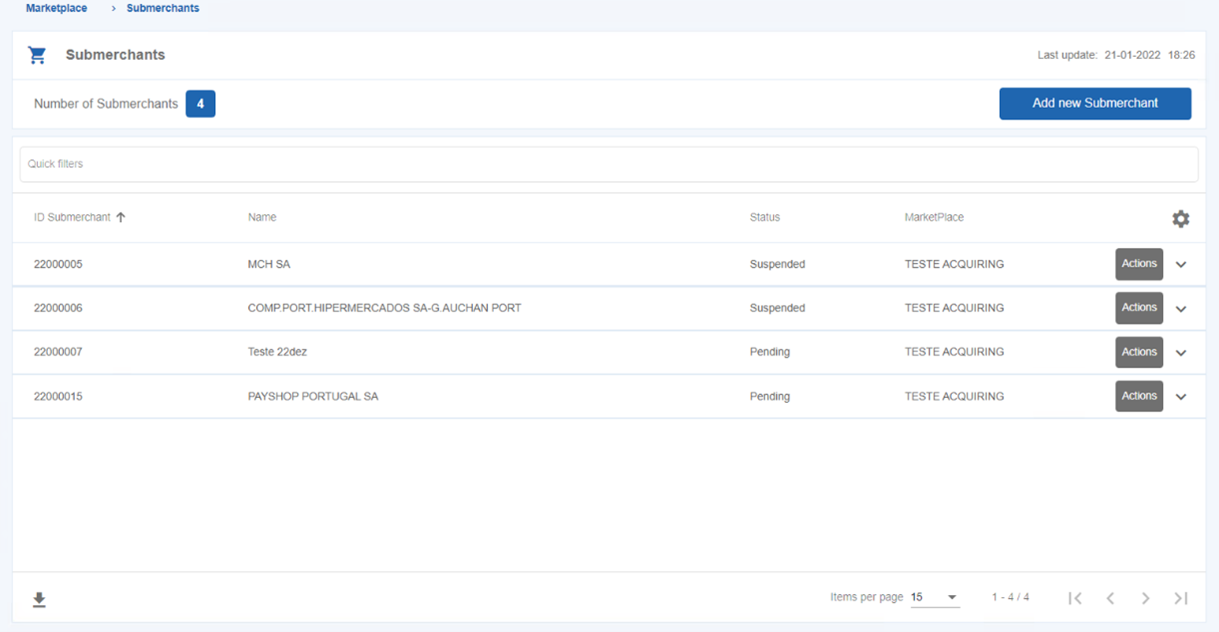

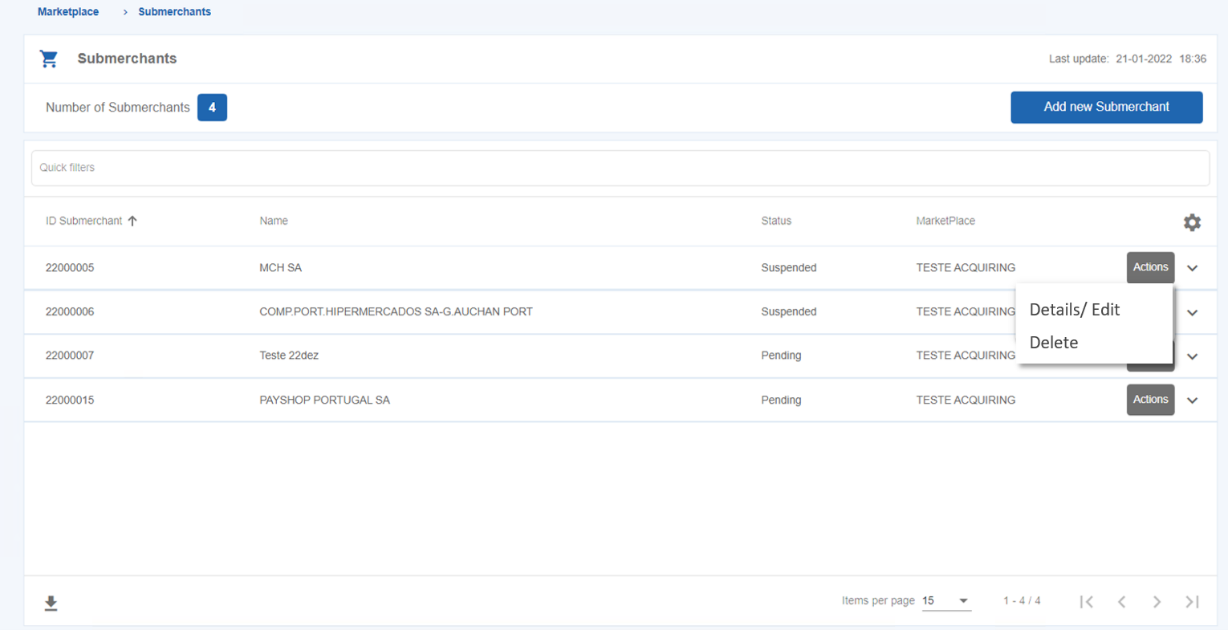

Through the “Submerchants” submenu, the Marketplace Operator can list Submerchants registered in the Marketplace, register new Submerchants or view details of a Submerchant registered in the solution.

In the “Submerchants” submenu, the list of Submerchants registered in the Marketplace is displayed, with the possibility of extracting the detailed information in a CSV file. In this submenu it is also possible to register new Submerchants.

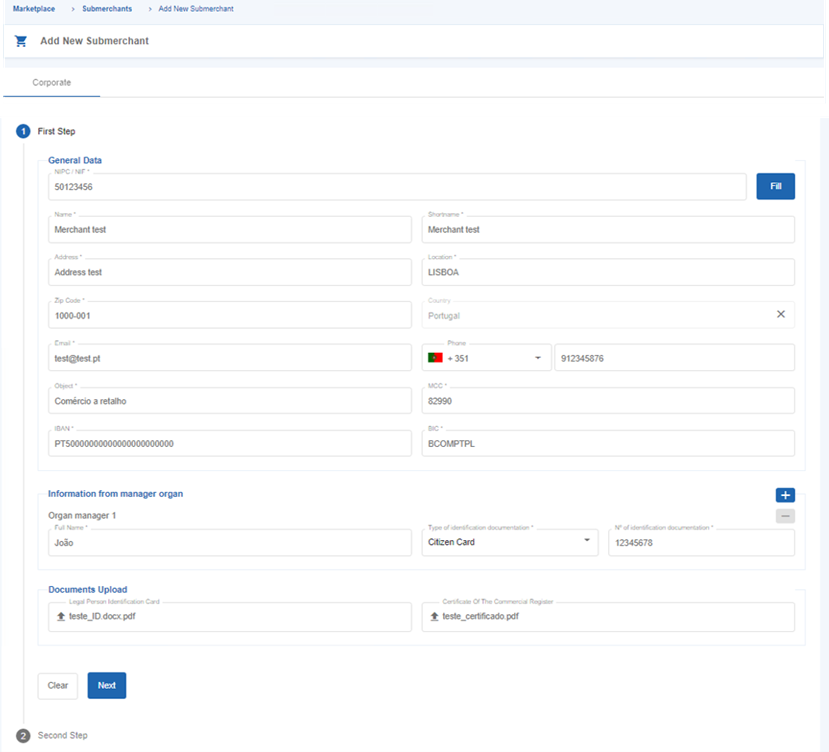

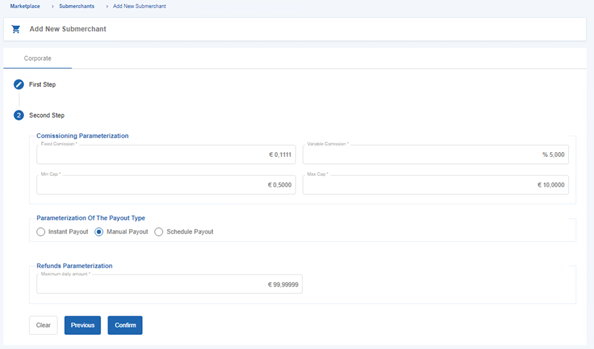

The registration of Submerchants can be done in SIBS Backoffice. This feature can be performed by the Marketplace Operator by clicking on the “Add new Submerchant” button on the top right hand corner of the figure above. By clicking on that button, the screen below will be displayed.

These screens display the fields required to complete the registration and KYC process. However, the following fields are mandatory for the registration of Submerchants in the Marketplace solution:

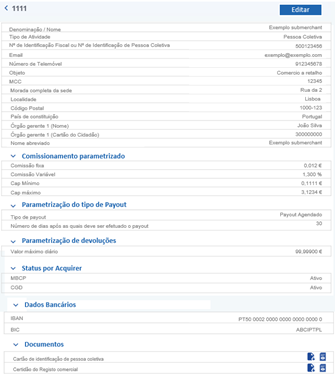

On the ellipsis button (“…”) associated to a certain Submerchant, on selecting the “Details/Edit” option, the User is directed to a page displaying all the information of a specific Submerchant.

The page displayed below provides the User with all the detailed information, organised by sections, relating to a particular Submerchant. On this page, using the “Edit” button, the User may also change the data entered, with the exception of the field “Taxpayer Identification No. or Legal Person Fiscal Number”. If the User wishes to search for specific information, he or she may also use the “Quick search filters” made available by SIBS Backoffice.

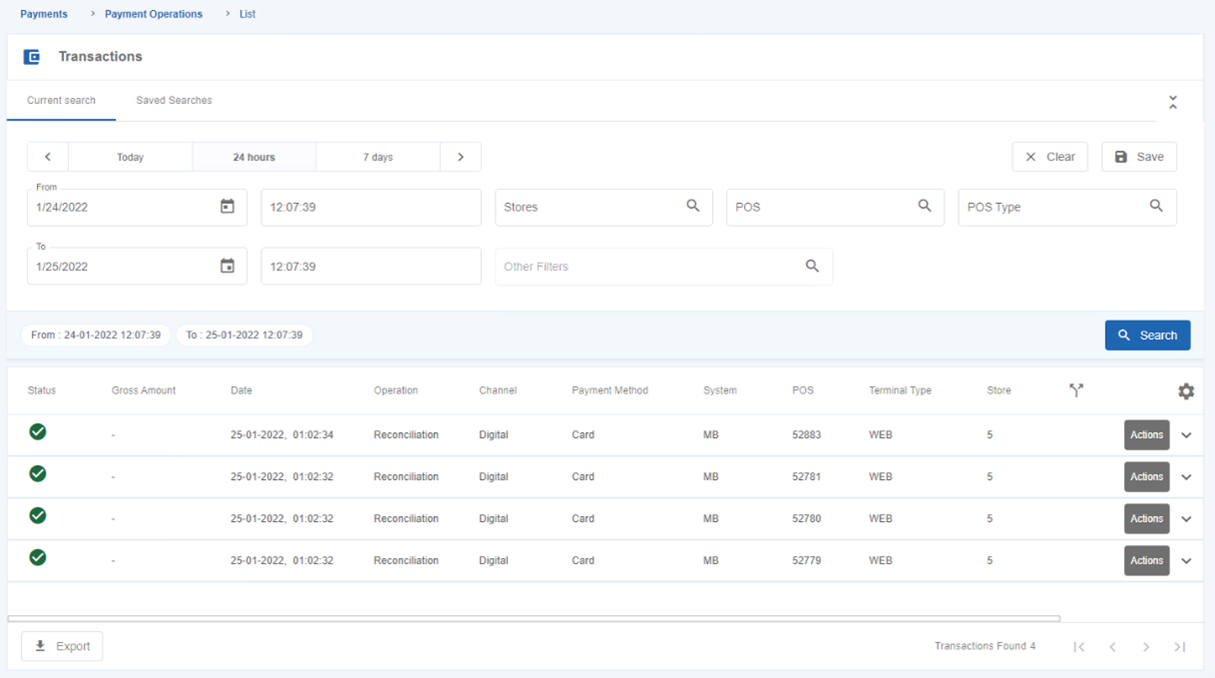

The transactions processed in the Marketplace solution are presented in SIBS Backoffice in the same listing as the Merchant’s operations in the other channels. In this way, the Merchant has an aggregated view of all his transactions across all his channels and businesses. The User can identify the operations processed in the Marketplace solution through the “Terminal Type” field visible in the following figure.

Allows the Marketplace Operator to post (send) splits and payouts of a purchase.

POST /sibs/v1/split/{split-type}This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum lenght | Maximum length | Type |

|---|---|---|---|---|---|---|

| “split-type” | Split Type | “Purchase” “Refund” | String | – | – | Mandatory |

| “submerchant” | ||||||

| “code” | Submerchant Code | – | Numeric | 8 | 8 | “submerchant” |

| “externalTransactionId” | Transaction external ID | – | String | 1 | 32 | |

| “originalSplitTransactionId” | split original ID | – | String | 1 | 14 | |

| “split” – “amount” | Split Amount | – | Numeric | 12.6 | 12.6 | “split” |

| “split” – “currency” | Currency Code | “968” – EURO | Numeric | 3 | ||

| “splitFee” – “amount” | MO free amount | – | Numeric | 12.6 | ||

| “splitFee” – “currency” | MO free currency | “968” – EURO | Numeric | 3 | ||

| “SplitSchedulingDate” | PayoutDate | – | Date | – | – |

Allows the Marketplace Operator to change the payout date of a split.

PUT /sibs/v1/splitThis feature requires sending parameters at the Request level that have the following characteristics:

| Parameters | Meaning | Accepted values and their meaning | Format | Minimum lenght | Maximum lenght | Type |

|---|---|---|---|---|---|---|

| “submerchant” | ||||||

| “code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

| “externalTransactionId” | Transaction external ID | – | String | 1 | 32 | Mandatory |

| “payoutReschedulingDate” | Payout Date | – | Date | – | – | Mandatory |

Allows to view the split list and payout scheduling for a particular Submerchant.

GET /sibs/v1/split/transactions| Parameter | Meaning | Accepted values and their meaning | Format | Minimum lenght | Maximum lenght | Type |

|---|---|---|---|---|---|---|

| “Submerchant-Code” | Submerchant Code | – | String | 8 | 8 | Mandatory |

| “Split-Transaction-Last-ID” | No. of split from which to send the list of splits per Submerchant | – | String | 1 | 14 | Optional |

Allows the Marketplace Operator to inquire a particular split.

GET /sibs/v1/spli/transactionThis feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum lenght | Maximum lenght | Type |

|---|---|---|---|---|---|---|

| “Split-Transaction-ID” | Split Identifier | – | String | 1 | 14 | Mandatory |

Allows the Marketplace Operator to add a new Submerchant.

Access via SIBS API Market:

POST /sibs/v2/submerchant This feature requires sending parameters at the Request Level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant” | ||||||

| “taxIdentificationNumber” | Taxpayer Identification Number or Legal Person Fiscal Number | – | String | 1 | 20 | Mnafatory |

| “name” | Nmae | – | String | 1 | 40 | Mandatory |

| “shortName” | Short Name; | – | String | 1 | 20 | Mandatory |

| “sic” | SIC – Standard Industrial Classification Code – (CAE: Classificação das Atividades Económicas) | – | Decimal | 1 | 5 | Mandatory |

| “socialObject” | Business Activity | – | String | 1 | 150 | Optional |

| “Settlement TypeCode” | Clearing type | “SPA” – Single Euro Payments Area | String | 3 | 3 | Mandatory |

| “refundMaxAmoun” | Daily maximum amount for Refunds | – | Decimal | 1 | 14.5 | Optional |

| “payoutTypeCode” | Payout type | “MAN” – Manual Payout “AUT” – Automatic Payout “SCH” – Scheduled | Char | 3 | 3 | Mandatory |

| “deferredAgreementDays” | Number of days after which the payout should be made | – | Number | 3 | 3 | Mandatory |

| “financial” | ||||||

| “IBAN” | International Bank Account Number | – | String | 3 | 34 | Mandatory |

| “BIC” | Bank International Code | – | String | 1 | 11 | Mandatory |

| “address” | ||||||

| “street” | Address | – | String | 1 | 40 | Optional |

| “postalCode” | Postal Code | – | String | 1 | 25 | Optional |

| “locality” | City | – | String | 1 | 20 | Optional |

| “postalLocality” | Postal Code locality | – | String | 1 | 10 | Optional |

| “country” | Country | Country ISO-3166 Numeric 3 | Numeric | 3 | 3 | Mandatory |

| “contact” | ||||||

| “email” | – | String | 1 | 55 | Optional | |

| “telephone” | Phone Number | – | String | 1 | 16 | Optional |

| “mobilePhone” | Mobile Phone Number | – | String | 1 | 16 | Optional |

Allows the Marketplace Operator to add or change an agreement per each Submerchant.

Access via SIBS API Market:

POST /sibs/v2/submerchant/{submerchant-id}/commission This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

| “comission” | ||||||

| “feeFixedValue” | Fixed value | – | Decimal | 1 | 7.3 | Mandatory |

| “feePercentage” | Variable value | – | Decimal | 1 | 8.3 | Mandatory |

| “splitFeeMinAmount” | Minimum “Cap” | – | Decimal | 1 | 10.4 | Mandatory |

| “splitFeeMaxAmount” | Maximum “Cap” | – | Decimal | 1 | 10.4 | Mandatory |

Allows the Marketplace Operator to change the characteristics of the Submerchant.

Access via SIBS API Market:

PUT /sibs/v2/submerchant/{submerchant-id} This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code”9 | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

| “submerchant” | ||||||

| “taxIdentificationNumber” | Taxpayer Identification Number or Legal Person Fiscal Number | – | String | 1 | 20 | Mnafatory |

| “name” | Nmae | – | String | 1 | 40 | Mandatory |

| “shortName” | Short Name; | – | String | 1 | 20 | Mandatory |

| “sic” | SIC – Standard Industrial Classification Code – (CAE: Classificação das Atividades Económicas) | – | Decimal | 1 | 5 | Mandatory |

| “socialObject” | Business Activity | – | String | 1 | 150 | Optional |

| “Settlement TypeCode” | Clearing type | “SPA” – Single Euro Payments Area | String | 3 | 3 | Mandatory |

| “refundMaxAmoun” | Daily maximum amount for Refunds | – | Decimal | 1 | 14.5 | Optional |

| “payoutTypeCode” | Payout type | “MAN” – Manual Payout “AUT” – Automatic Payout “SCH” – Scheduled | Char | 3 | 3 | Mandatory |

| “deferredAgreementDays” | Number of days after which the payout should be made | – | Number | 3 | 3 | Mandatory |

| “financial” | ||||||

| “IBAN” | International Bank Account Number | – | String | 3 | 34 | Mandatory |

| “BIC” | Bank International Code | – | String | 1 | 11 | Mandatory |

| “address” | ||||||

| “street” | Address | – | String | 1 | 40 | Optional |

| “postalCode” | Postal Code | – | String | 1 | 25 | Optional |

| “locality” | City | – | String | 1 | 20 | Optional |

| “postalLocality” | Postal Code locality | – | String | 1 | 10 | Optional |

| “country” | Country | Country ISO-3166 Numeric 3 | Numeric | 3 | 3 | Mandatory |

| “contact” | ||||||

| “email” | – | String | 1 | 55 | Optional | |

| “telephone” | Phone Number | – | String | 1 | 16 | Optional |

| “mobilePhone” | Mobile Phone Number | – | String | 1 | 16 | Optional |

Allows the Marketplace Operator to change the parameters of the agreement between the Marketplace Operator and each Submerchant.

Access via SIBS API Market:

PUT /sibs/v2/submerchant/{submerchant-id}/commission This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

| “comission” | ||||||

| “feeFixedValue” | Fixed value | – | Decimal | 1 | 7.3 | Mandatory |

| “feePercentage” | Variable value | – | Decimal | 1 | 8.3 | Mandatory |

| “splitFeeMinAmount” | Minimum “Cap” | – | Decimal | 1 | 10.4 | Mandatory |

| “splitFeeMaxAmount” | Maximum “Cap” | – | Decimal | 1 | 10.4 | Mandatory |

The following table provides the various possible statuses applicable to Submerchants, as well as a description of the permissions inherent to each status. The deadlines for moving from one status to the next are also provided.

Status |

Transaction |

Payout |

Detail |

Deadlines |

Active |

Standard status of a Submerchant, which is already validated by the Acquirer, if applicable. It can make sales as well as receive payouts. |

n.a. |

||

Pending |

This status only applies where KYC is performed by the Acquirer(s). The Submerchant will remain in this status until validation by the Acquirer(s). In this status, the Submerchant can make sales, but cannot receive payouts. |

30 days |

||

Suspended |

The Submerchant will remain in this status if it exceeds 30 days in the KYC process. In this status, the Submerchant cannot make sales, nor receive payouts. Within the first 30 days, the Submerchant can move to the ‘Active’ status if the KYC process is completed. After this deadline, the Submerchant moves to the ‘Deleted’ status. |

30 days |

||

Deleted |

The customer goes to the ‘Deleted’ status in the following situations: -When it exceeds 30 days in the ‘Suspended’ status; -When it is refused by the Acquirer; -When the Onboarding process is cancelled by one of the parties (Submerchant or Marketplace Operator); -When the Customer ceases to be part of the Marketplace. After being deleted, a Submerchant will again have to go through the onboarding process. |

n.a. |

Allows the Marketplace Operator to change the status of the Submerchant associated with the Marketplace Operator.

Access via SIBS API Market:

PUT /sibs/v2/submerchant/{submerchant-id} This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

| “submerchant” | ||||||

| “statusCode” | Submerchant status | “ACT” – Active “PND” – Pending “SUS” – Suspended | Chart | 3 | 3 | Mandatory |

Allows to view of the Submerchant’s characterisation details.

Access via SIBS API Market:

GET /sibs/v2/submerchant/{submerchant-id} This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

Allows the Marketplace Operator to inquire the agreement positioned for each Submerchant.

Access via SIBS API Market:

GET /sibs/v2/submerchant/{submerchant-id}/commission This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

Allows the Marketplace Operator to delete the Submerchant (by changing its status). This action is irreversible.

Access via SIBS API Market:

DELETE /sibs/v2/submerchant/{sub- merchant-id} This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “submerchant-code” | Submerchant Code | – | Numeric | 8 | 8 | Mandatory |

Allows listing all Submerchants, or only those whose validation is pending, by the Marketplace Operator.

Access via SIBS API Market:

GET /sibs/v2/submerchant This feature requires sending parameters at the Request level that have the following characteristics:

| Parameter | Meaning | Accepted values and their meaning | Format | Minimum length | Maximum length | Type |

|---|---|---|---|---|---|---|

| “Submerchant- Type” | Submerchant type per status | “ALL” – All Submerchant ‘SPV’ – Submerchant Pending Validation | String | 3 | 3 | Mandatory |

| “Submerchant-Last-ID” | No. of split from which to send the list of splits per Submerchant | – | String | 8 | 8 | Optional |

The Marketplace solution presupposes the availability of APIs which, in turn, make it possible to carry out a variety of operations. The following subsections detail each of these.

Split payments is the partition of funds amongst the Marketplace Operator and Submerchants. Every split is fully customized by the Marketplace Operator, who is in charge of defining split rules, according to the terms negotiated with each Submerchant, and the fees associated with the transaction, when applicable.

The split request process is triggered by the Marketplace Operator via Split API. Splits can be triggered transaction by transaction, i.e. payment by payment, or in bulk, for example at the end of the day or the month.

There are two types of splits: purchase and refund. A split refund annuls the split amount to be transferred, if the payout has not yet been processed.

The provisioning and risk of the escrow account is the responsibility of the Marketplace Operator. In order to execute the respective transfers, the account must always be provisioned, and it cannot have negative values.